Roll-Up Reality

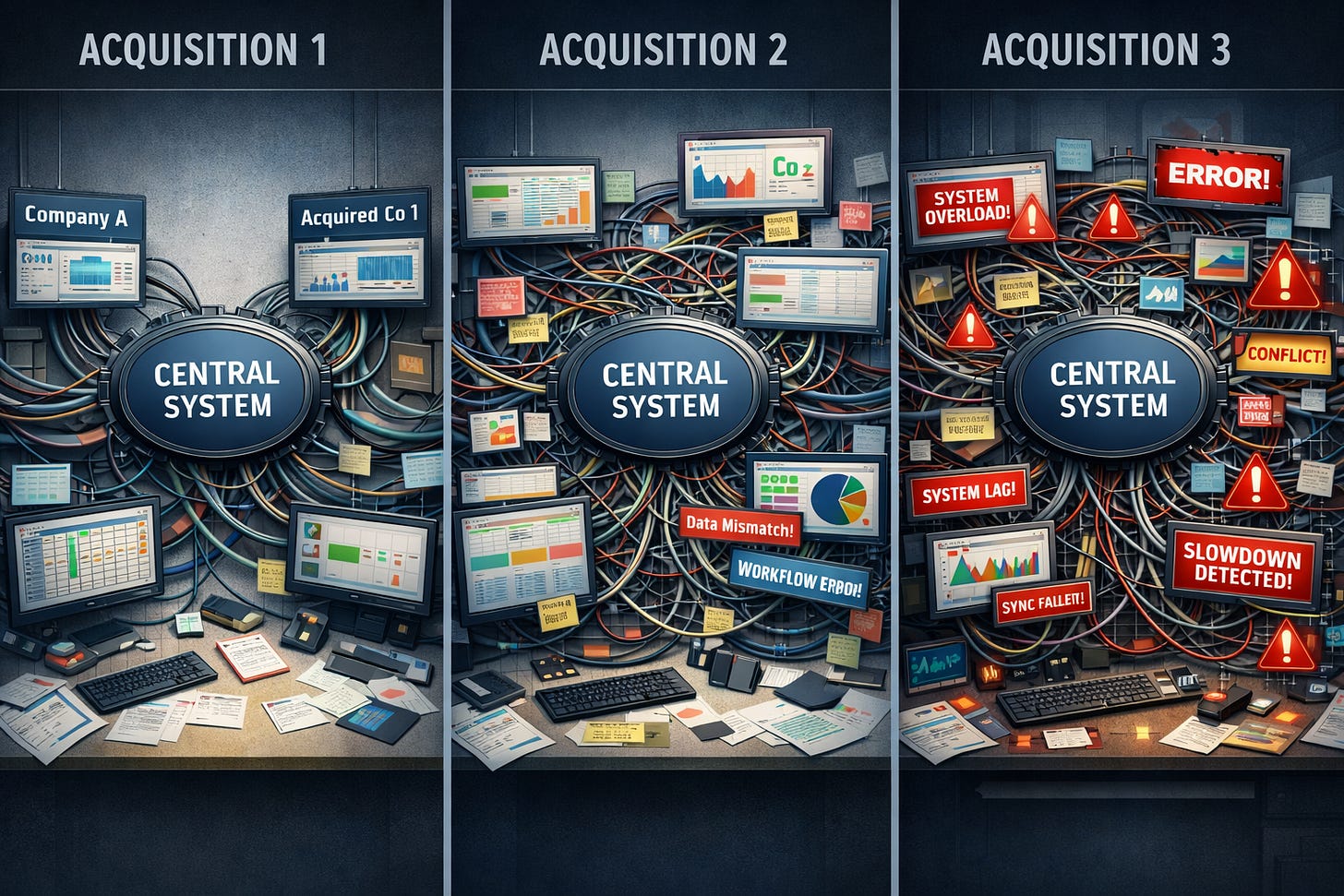

Why Most Platforms Fail After Acquisition #3

Roll-ups look easy on paper.

Buy a platform.

Add tuck-ins.

Scale fast.

Exit big.

And yet most roll-ups don’t collapse on the first deal.

They collapse after the third.

That’s when complexity compounds, cracks widen, and the story breaks.

Here’s why most platforms fail right there and what the survivors do differently.

1️⃣ The Platform Was Never a Platform

Most “platforms” are just owner-operated businesses with size.

They have revenue.

They have EBITDA.

But they don’t have infrastructure.

By acquisition #3, the truth shows up:

no standardized processes

no real middle management

no integration muscle

no repeatable playbook

A real platform absorbs businesses.

A fake one gets overwhelmed by them.

If the first company can’t run without the founder, it can’t carry others.

2️⃣ Integration Debt Compounds Faster Than Financial Debt

Every acquisition creates integration work:

systems alignment

payroll harmonization

reporting standards

cultural blending

decision rights

Most buyers ignore this and keep buying anyway.

By deal #3, integration debt exceeds operating capacity.

Things slow.

Mistakes multiply.

Good people leave.

You didn’t build a roll-up.

You built a fragile stack.

Growth without integration discipline is just delayed failure.

3️⃣ Culture Breaks Before Cash Flow Does

Here’s the silent killer.

Each acquired business brings:

its own habits

its own incentives

its own norms

its own unspoken rules

Founders assume culture will “figure itself out.”

It won’t.

By the third acquisition:

managers resist change

teams stop trusting leadership

accountability gets blurry

performance becomes inconsistent

Buyers don’t lose deals because of spreadsheets.

They lose them because culture stops executing the plan.

4️⃣ The Operator Becomes the Bottleneck Again

Roll-ups are supposed to reduce dependency.

Instead, many buyers recreate it at scale.

The operator:

approves every decision

resolves every conflict

closes every fire

knows every exception

By acquisition #3, the operator is back in the weeds only now across multiple companies.

The business didn’t scale.

The stress did.

If everything routes through you, nothing is scalable.

5️⃣ Capital Structure Gets Ahead of Capability

Debt is easy early.

Banks love momentum.

Sellers carry notes.

Everyone believes the story.

Then execution lags.

By the third deal:

debt service tightens

covenants matter

mistakes become expensive

flexibility disappears

Leverage only works when operations are boring and predictable.

Chaos plus leverage equals collapse.

Most roll-ups fail not because they bought bad businesses

but because they bought them too fast.

Final Thought – Roll-Ups Don’t Fail From Lack of Deals

They fail from lack of discipline.

Acquisition #3 is where fantasy meets reality.

Where systems matter more than sourcing.

Where leadership replaces hustle.

Where patience beats speed.

The winners slow down there.

They integrate.

They professionalize.

They earn the right to buy again.

Because in roll-ups, survival isn’t about how many companies you buy —

it’s about how well you absorb them.

💼 If this changed how you think about roll-ups:

Share it with someone chasing a platform.

And subscribe to Buy Build Exit real lessons from operators who’ve been through the fire.

👉 Subscribe here | Real platforms. Real integration. Real outcomes.